cameroon gce A level 2024 cost and management accounting 1

cameroon gce A level 2024 cost and management accounting 1

SECTION A: COST ACCOUNTING

1

• An enterprise orders annually 220,000 kg of a

material . The unit purchase price is 3000 CFAF.

The cost of placing an order is 66,000 CFAF and

the carrying cost represents 20 % of the average

stock.

What is the optimal number of order to be placed ?

A 4 orders.

10 orders.

C 5 orders.

D 8 orders.

6. MAKA Enterprise had the following stock

record of raw materials in August 2021;

Opening stock 40 kg at 150 CFAF

raw

What is the cost per unit of closing stock for

MAKA Enterprise using the WACAEE method?

A 240.90 CFAF.

B 163.7 CFAF.

C 24,200 CFAF .

D 6,000 CFAF .

> B

2, The standard time allowed per unit for direct labour

is 7 hours. During January 2020, 1,000 units were

. produced taking 6,500 hours. The units budgeted

for the month had been 1,200. What is the number

of standard hours allowed for January?

A 6,500 hours.

B 7,800 hours.

C 8,400 hours.

D 7,000 hours.

<

•

7. In process costing, if an abnormal loss arises, the

process account is generally

A Debited with the scrap value of the

abnormal loss units.

B Debited with the full production cost of

the abnormal loss units.

C Credited with the scrap value of the

abnormal loss units.

D Credited with the full production cost of

the abnormal loss units.

3. Which of the variances below is calculated only for

fixed factory overhead?

A Price variance.

B Quantity variance.

C Production variance.

D Flexible budget variance.

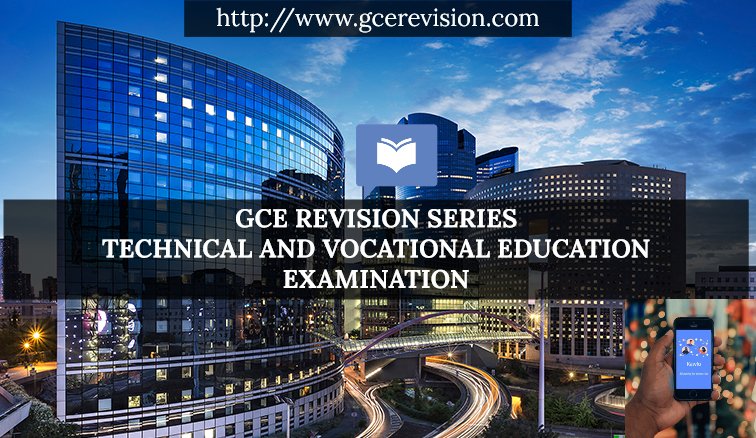

8. Use the following graph to answer the following

question.

CosU

4. The labour hours required to produce products X

and Y are 2 hours and 5 hours 30 minutes

respectively. If only 150 hours of direct labour

are available, what will be the labour hour

constraint ?

200,000

100,000

*Units

5.5X+2Y < 150.

2X+5.5Y > 150.

2X+5.5Y < 150.

5.5X+ 2Y = 150.

A 2,000 4,000 6,000

What is the total cost at activity level of 4,000 units

if unit variable cost is 300frs per unit?

BCD

A 1,400,000 CFAF.

B 200,000 CFAF.

C 100,000 CFAF.

D 1,300,000 CFAF.

5. A company’s process B had no opening inventory.

13,500 units of raw materials were transferred in at

4.50 CFAF per unit. Additional material at 1.25

CFAF per unit was added in the process. Labour and

overheads were 6.25 CFAF per completed unit and

2.50 CFAF per unit incomplete. If 11,750 completed

units were transferred out, what was the closing

inventory in Process B?

A 6562.5 CFAF

B 12,250 CFAF

C 14,437.5 CFAF

D 25,375 CFAF