cameroon gce intermediate level 2024 ohada financial accounting 2

cameroon gce intermediate level 2024 ohada financial accounting 2

Mr TITA is a food stuff vendor in Tiko Market, For the month of February 2022, some of his transactions

recorded were as follows:

| 150 Buckets of garri at 735,000 CFAF total 200 Buckets of Cocoyam at 4,000 CFAF each Fie incurred a total of 61,250CFAF on the two food stuffs Distribution expenses of 16.250 CFAF for telephone airtime, truck and taxi fares |

Purchases | |

| Transportation: Distribution |

||

| Stock situation | Initial stock; None | |

| Final Stock: 10 Buckets of garri and 15 Buckets of cocoyam | ||

| Sales | A bucket of garri = 5,000 CFAF; | A bucket of cocoyam = 6,000 CFAF |

Other information Transport and distribution expenses are indirect expenses to be shared to the two

foodstuffs as indicated in appendix 1

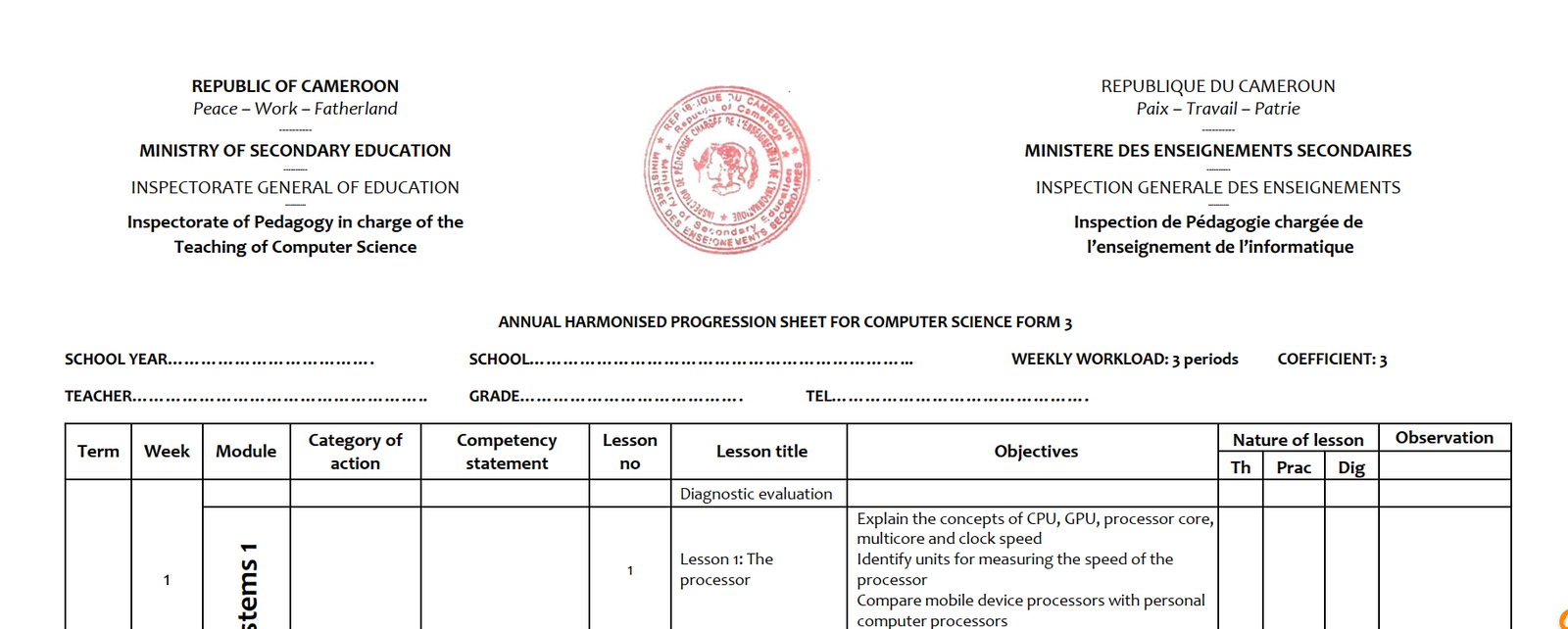

Required: Using appendix 1

i. Complete the apportionment table of indirect expenses,

ii. Calculate the Purchase Cost of the two foodstuffs,

iii. Determine the cost price of the foodstuffs,

iv. Determine the costing result of the foodstuffs,

v. Interpret the result of the two foodstuffs,

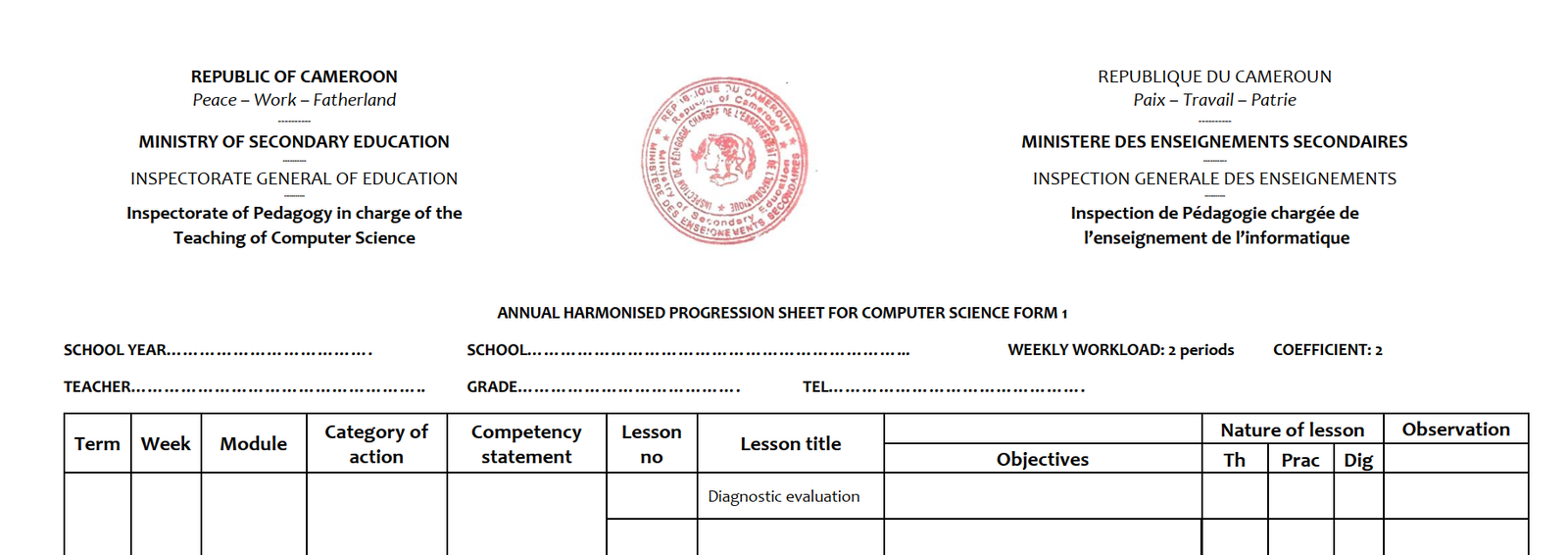

2. The balance sheet of ETLA entity presented the situation of containers as follows on the December 31, 2021.

3352 Returnable containers in the warehouse; 320,000 CFAF

3352 Returnable containers on consignment; 179,200 CFAF

4194 Customers debts on containers 235,200 CFAF

The entity uses the same price of 1,600 CFAF per crate to value all stock exits.

During the month of January 2022, the following transactions were realised:

02/01 Purchase of 88 crates for 132,000 CFAF tax exclusive in all,

07/01 Consignment of 12 crates to Ekeke,

10/01 Return of 10 crates by Fulefack,

16/01 Non return of 7 crates by Tah,

24/01 Destruction of 2 crates in the warehouse,

30/01 Return of 25 crates by Atem at 1,800 FAF.

Required: Determine

i. The number of crates in the warehouse,

ii. The total number of crates owned by the entity,

iii. The consignment price of a crate,

iv. Record the transactions on crates realised during the month in the classical journal.

NB: Consider the consignment price of 2,200 CFAF

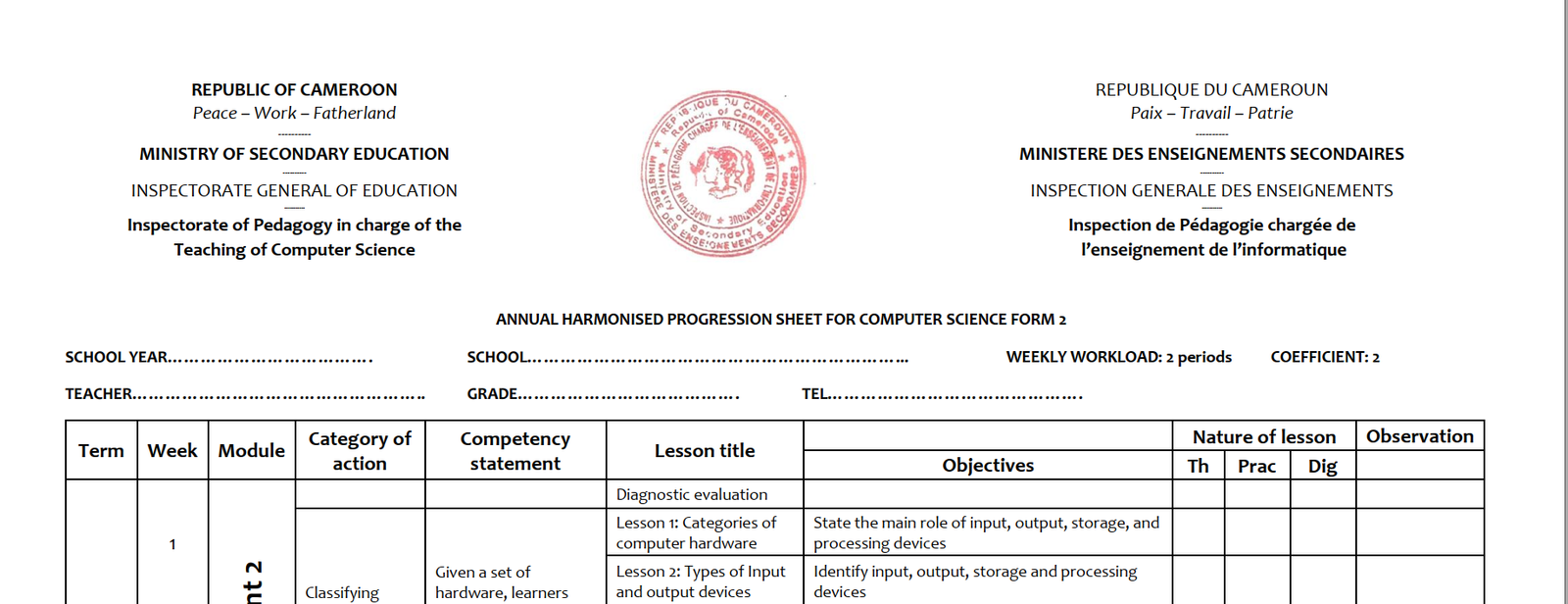

3. You are an employee at FECHOU Enterprise. The enterprise uses the Centralized System of Accounting. On

January 30 2020, the Manager hands to you a file containing the following transactions which took place during

the month of January 2020:

| January 2 | Credit purchase of goods |

| January 4 | Cash purchases of goods |

| January 10 | Credit sales of goods |

| January 13 | Cash sales of goods by bank cheque |

| January 18 | Received from Customers by bank cheque |

| January 30 | Paid bank cheque to a supplier |

100,000 CFAF

200,000 CFAF

150,000 CFAF

170

,000 CFAF

39

,000 CFAF

25,000 CFAF